The Bank of Japan’s unexpected rate hike could trigger currency volatility and capital outflows from the ROK

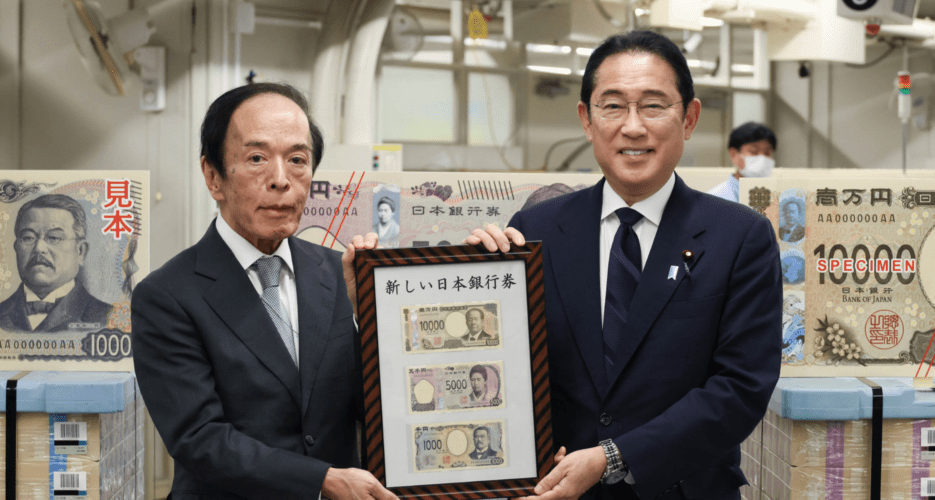

The Bank of Japan (BOJ) unexpectedly raised its overnight call rate target on Wednesday to 0.25% from the previous 0 to 0.1% range, marking the highest level since 2008. While it is still low by global standards, this relative spike reflects the BOJ’s broader strategy to move toward a more normalized monetary policy.

This shift poses three primary risks for South Korea: heightened exchange rate volatility, potential capital outflows and threats to economic stability.

The Bank of Japan (BOJ) unexpectedly raised its overnight call rate target on Wednesday to 0.25% from the previous 0 to 0.1% range, marking the highest level since 2008. While it is still low by global standards, this relative spike reflects the BOJ’s broader strategy to move toward a more normalized monetary policy.

This shift poses three primary risks for South Korea: heightened exchange rate volatility, potential capital outflows and threats to economic stability.

Get your

KoreaPro

subscription today!

Unlock article access by becoming a KOREA PRO member today!

Unlock your access

to all our features.

Standard Annual plan includes:

-

Receive full archive access, full suite of newsletter products

-

Month in Review via email and the KOREA PRO website

-

Exclusive invites and priority access to member events

-

One year of access to NK News and NK News podcast

There are three plans available:

Lite, Standard and

Premium.

Explore which would be

the best one for you.

Explore membership options

© Korea Risk Group. All rights reserved.

No part of this content may be reproduced, distributed, or used for

commercial purposes without prior written permission from Korea Risk

Group.