|

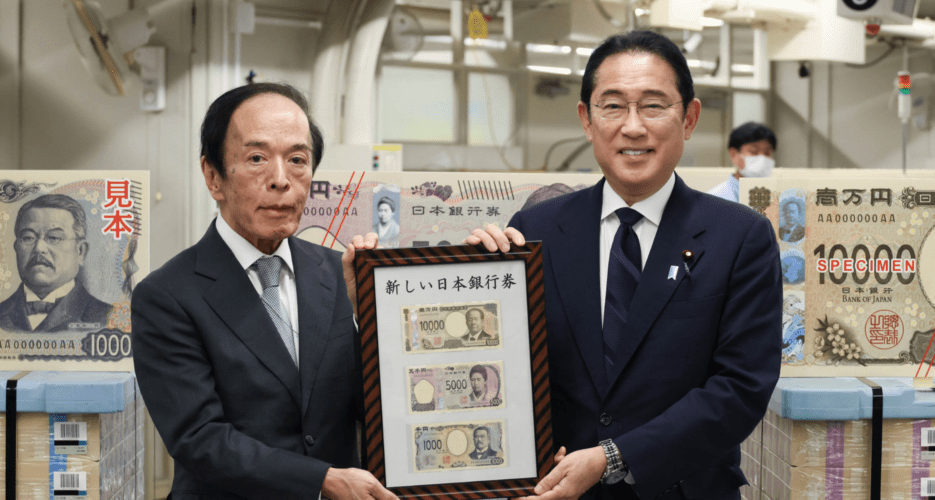

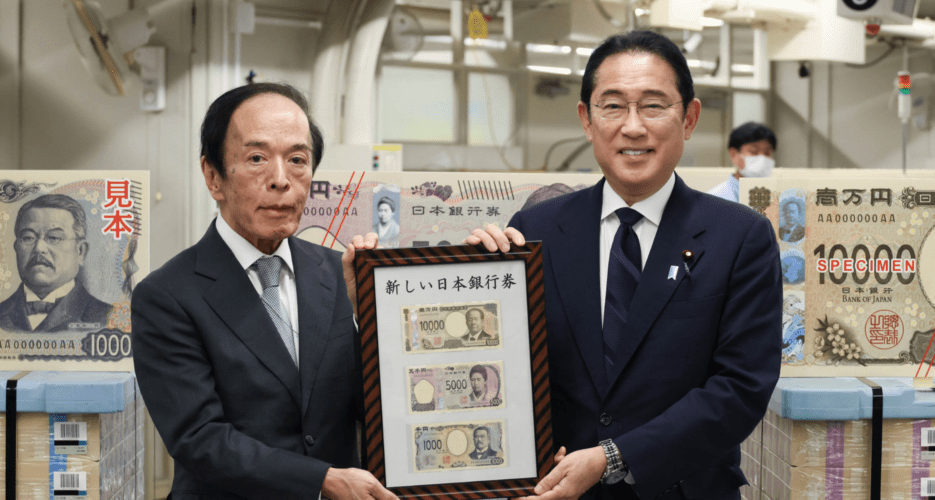

Analysis South Korea braces for economic turbulence following Japan’s interest rate hikeThe Bank of Japan’s unexpected rate hike could trigger currency volatility and capital outflows from the ROK John LeeAugust 1, 2024  Japanese Prime Minister Fumio Kishida (right) meets with Bank of Japan Governor Kazuo Ueda on the occasion of the issuance of the country's new banknotes, July 3, 2024 | Image: Prime Minister's Office of Japan The Bank of Japan (BOJ) unexpectedly raised its overnight call rate target on Wednesday to 0.25% from the previous 0 to 0.1% range, marking the highest level since 2008. While it is still low by global standards, this relative spike reflects the BOJ’s broader strategy to move toward a more normalized monetary policy. This shift poses three primary risks for South Korea: heightened exchange rate volatility, potential capital outflows and threats to economic stability. The South Korean won has already been under pressure, depreciating against the U.S. dollar amid global economic uncertainties. This new development could exacerbate the won’s depreciation, increasing import costs and inflationary pressures. Additionally, the allure of higher returns in Japan might prompt investors to withdraw their money from South Korea, resulting in capital outflows that may destabilize financial markets and further weaken the currency. The Bank of Korea (BOK), which has maintained its interest rate at 3.5% to combat inflation, faces the task of navigating these new external pressures while balancing domestic economic challenges such as rising household debt and political demands for lower interest rates. As such, the BOK will likely adopt a cautious approach, maintaining its current rate while signaling readiness to adjust if necessary to counteract excessive currency depreciation or capital outflows, support the won, ensure financial stability and manage inflation without placing undue burdens on households and businesses. CURRENT ECONOMIC INDICATORS As of June, South Korea’s inflation rate had slowed to 2.4%, approaching the BOK’s target of 2%. This deceleration in inflation reflects a stabilization of consumer prices, following heightened inflationary pressures driven by supply chain disruptions and increased import costs. Additionally, South Korea’s GDP growth is projected at 2.6% in 2024. Despite this positive growth outlook, the country faces significant economic challenges. Household debt, primarily mortgage loans, rose by $20.6 billion (26.5 trillion won) in the first half of 2024, the highest increase in three years. Moreover, the South Korean won has depreciated against the U.S. dollar, with an exchange rate of about 1,370 won per dollar, driven by a strong dollar and weak yen. The BOK’s policies have led to considerable political pressure to reduce interest rates. For instance, Prime Minister Han Duck-soo expressed optimism about a potential interest rate cut earlier in July, suggesting a preference for accommodative monetary policy to support economic recovery and address social concerns. However, businesses and consumers are strained, with the business sentiment index for the third quarter of 2024 marking a 10-point decline, according to the Korea Chamber of Commerce and Industry. Consumer confidence is similarly affected by economic uncertainties. Rising household debt and high borrowing costs have led to cautious spending behavior, further slowing economic momentum.  Bank of Korea, July 26, 2024 | Image: Korea Pro RISKS FROM BOJ’S HIKE The BOJ’s decision to raise its overnight call rate target will likely lead to exchange rate volatility. As the yen has appreciated in response to the rate hike, the South Korean won will face increased pressure to depreciate further against both the yen and the U.S. dollar for Korean exporters to remain competitive. However, given the current exchange rate, additional depreciation will likely exacerbate existing economic challenges. For instance, a weaker won would lead to higher import costs, particularly for essential goods and raw materials. This would contribute to inflationary pressures, undermining the recent progress in stabilizing inflation. The BOJ’s rate hike also raises the risk of capital outflows from South Korea to Japan. Higher interest rates in Japan, reflecting Tokyo’s growing confidence in its economy, may attract investors seeking better returns, leading to a shift in capital from South Korean markets. Such capital movements can strain the BOK’s efforts to maintain currency stability and manage inflation, forcing the central bank to consider further interventions. From January to May, South Korea saw significant capital outflows, with residents investing $27.94 billion overseas, outpacing the $21.09 billion in domestic foreign investments. BOK’S LIKELY RESPONSE The BOK will likely adopt a cautious yet flexible short-term approach in response to the BOJ’s rate hike, as it has prioritized controlling inflation and stabilizing the currency. However, BOK Governor Rhee Chang-yong has stated that the bank is prepared to adjust rates based on evolving economic conditions. Should the won’s depreciation accelerate or capital outflows intensify, the bank may consider maintaining rates for longer. Conversely, if the country’s weak domestic consumption persists, the BOK may consider a rate cut to stimulate growth. Additionally, the BOK may further intervene in the foreign exchange market via currency reserve swaps to stabilize the won and address exchange rate volatility, which may have the unintended effect of eroding small businesses’ cost advantage in the export market. Further, the BOK, the finance ministry and the Financial Supervisory Service will likely push for secondary regulatory measures to manage household debt and ensure financial stability, such as enforcing stricter lending standards and enhancing supervision of financial institutions.  Bank of Korea Governor Rhee Chang-yong holds a press briefing to discuss the central bank’s monetary policy direction, July 11, 2024 | Image: Bank of Korea FINANCIAL MARKET REACTIONS The BOJ’s rate hike, coupled with the Federal Reserve’s decision on Thursday to keep rates steady while hinting at potential cuts in September, will likely complicate South Korea’s financial markets. The impact on South Korea’s bond market may be mixed. While the BOJ’s rate hike could push South Korean bond yields up, the Fed’s hint at future rate cuts may exert downward pressure on yields. For instance, the yield on South Korea’s 10-year government bond, which slipped below the 3% level for the first time since April 2022 before these announcements, might experience heightened volatility. It may moderately spike in response to the BOJ’s decision, only to retreat as markets price in potential Fed rate cuts. The currency market will likely see the South Korean won caught between opposing forces. The BOJ’s rate hike could strengthen the yen against the won, but the prospect of Fed rate cuts could weaken the dollar, potentially benefiting the won. In the money market, the anticipation of potential Fed rate cuts might partially offset the upward pressure on interest rates from the BOJ’s hike. The Korean Interbank Offered Rate, a key benchmark for short-term lending, might edge up from its current 3.5%, but then hold steady rather than continuing to rise as it typically would following a rate hike by a major trading partner. The derivatives market may see heightened activity as investors and businesses seek to hedge against increased currency and interest rate uncertainties. The daily trading volume of USD/KRW futures on the Korea Exchange may surge as market participants rush to protect themselves against potential currency swings. Several key factors will influence these market reactions. The timing and magnitude of potential Fed rate cuts will be crucial. If the Fed signals a 25-basis-point cut in September, the impact on South Korean markets might be moderate. However, hints of a larger 50-basis-point cut could lead to more dramatic moves in both the won and South Korean bond yields. Global economic indicators also play a significant role. For instance, China’s National Bureau of Statistics announced in mid-July that the country’s second-quarter GDP rose by 4.7% year-on-year, missing expectations of 5.1% growth. This number will dampen sentiment toward Asian economies, exacerbating the negative impacts of the BOJ’s rate hike on South Korean markets. The BOK’s response will be pivotal. Despite robust export figures, weak domestic consumption will likely compel the BOK to maintain interest rates until September before it decides to join the global trend toward easing. Investors will likely see such a move as a dovish signal — that the Korean central bank is more concerned about economic growth and employment than inflation — potentially leading to a softening of the won and a rally in the South Korean stock market.  Korea Exchange, July 25. 2024 | Image: Korea Pro BROADER IMPACT South Korea’s economic policies must be viewed within the broader regional and global economic landscape. The BOJ’s rate hike contrasts with the trend in other major economies, such as the U.S., where the Federal Reserve is expected to cut rates in the coming months as inflationary pressures moderate. This divergence in monetary policy poses challenges for South Korea. A stronger yen and a potentially weaker dollar will likely shift trade balances and impact South Korean exports. While a weaker dollar might make imports more expensive for U.S. consumers, the overall impact on South Korean exports will depend on various factors, including shifting consumer preferences and competition from other markets. Further, international investors will scrutinize South Korea’s approach to fiscal and monetary policy. The BOK’s likely cautious stance, coupled with the government’s fiscal measures, may send mixed signals, eroding trust in South Korea’s economic growth prospects. The BOK’s response to the BOJ’s rate hike will be critical for South Korea’s economic health. The central bank will need to navigate domestic pressures, including high household debt and demands for economic stimulus, while also addressing external risks, such as capital outflows and exchange rate volatility. Vigilant monitoring, proactive household debt management, transparent communication and strategic coordination with global economic policies will be necessary to mitigate the risks posed by the BOJ’s policy shift. The coming months will reveal how effectively the BOK can adapt its strategies to support sustained economic growth and financial stability amid these evolving challenges. Edited by Alannah Hill The Bank of Japan (BOJ) unexpectedly raised its overnight call rate target on Wednesday to 0.25% from the previous 0 to 0.1% range, marking the highest level since 2008. While it is still low by global standards, this relative spike reflects the BOJ’s broader strategy to move toward a more normalized monetary policy. This shift poses three primary risks for South Korea: heightened exchange rate volatility, potential capital outflows and threats to economic stability. Get your

|

|

Analysis South Korea braces for economic turbulence following Japan’s interest rate hikeThe Bank of Japan’s unexpected rate hike could trigger currency volatility and capital outflows from the ROK  The Bank of Japan (BOJ) unexpectedly raised its overnight call rate target on Wednesday to 0.25% from the previous 0 to 0.1% range, marking the highest level since 2008. While it is still low by global standards, this relative spike reflects the BOJ’s broader strategy to move toward a more normalized monetary policy. This shift poses three primary risks for South Korea: heightened exchange rate volatility, potential capital outflows and threats to economic stability. © Korea Risk Group. All rights reserved. |