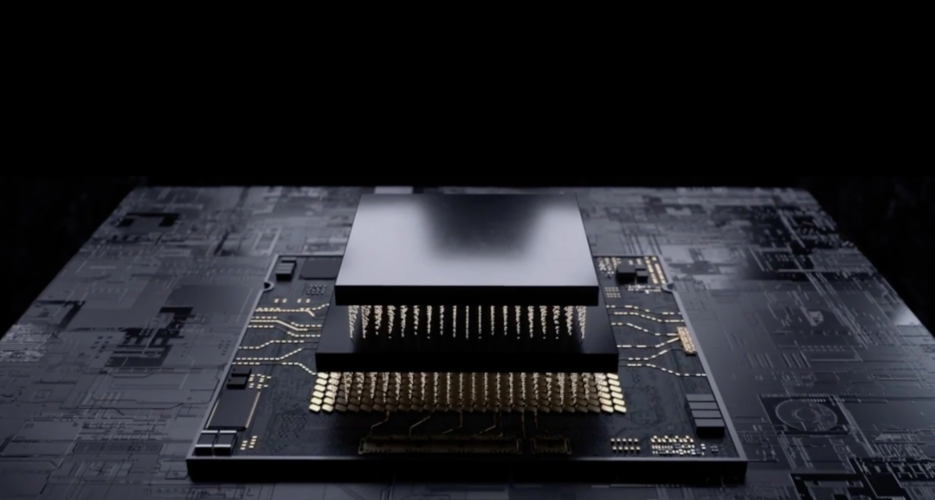

High-tech memory investment ramps up as Samsung fights to reclaim competitive edge in the AI semiconductor market

Samsung Electronics reported its third quarterly earnings with a 72.8% year-over-year increase in net income to $7.3 billion (10.1 trillion won), supported by strong sales in consumer electronics and mobile divisions. Revenue reached a record $57.4 billion (79.1 trillion won), though the semiconductor segment posted a weaker-than-expected operating profit of $2.8 billion (3.86 trillion won). Samsung highlighted “meaningful progress” in testing its HBM3E memory chips, aimed at AI applications, and anticipates expanded sales in the fourth quarter, briefly lifting investor sentiment and raising its stock by 3.6% post-announcement.

Despite this uptick, Samsung’s stock remains down 32% since July, reflecting skepticism over its position in advanced semiconductors. Ongoing certification delays in AI memory have enabled competitors like SK Hynix to gain significant market share. Samsung plans to invest in high-bandwidth memory, including next-generation HBM4, to shift its focus toward high-value products. However, investor sentiment remains cautious amid substantial competitive pressures and delays in market execution.

Samsung Electronics reported its third quarterly earnings with a 72.8% year-over-year increase in net income to $7.3 billion (10.1 trillion won), supported by strong sales in consumer electronics and mobile divisions. Revenue reached a record $57.4 billion (79.1 trillion won), though the semiconductor segment posted a weaker-than-expected operating profit of $2.8 billion (3.86 trillion won). Samsung highlighted “meaningful progress” in testing its HBM3E memory chips, aimed at AI applications, and anticipates expanded sales in the fourth quarter, briefly lifting investor sentiment and raising its stock by 3.6% post-announcement.

Despite this uptick, Samsung’s stock remains down 32% since July, reflecting skepticism over its position in advanced semiconductors. Ongoing certification delays in AI memory have enabled competitors like SK Hynix to gain significant market share. Samsung plans to invest in high-bandwidth memory, including next-generation HBM4, to shift its focus toward high-value products. However, investor sentiment remains cautious amid substantial competitive pressures and delays in market execution.

Get your

KoreaPro

subscription today!

Unlock article access by becoming a KOREA PRO member today!

Unlock your access

to all our features.

Standard Annual plan includes:

-

Receive full archive access, full suite of newsletter products

-

Month in Review via email and the KOREA PRO website

-

Exclusive invites and priority access to member events

-

One year of access to NK News and NK News podcast

There are three plans available:

Lite, Standard and

Premium.

Explore which would be

the best one for you.

Explore membership options

© Korea Risk Group. All rights reserved.

No part of this content may be reproduced, distributed, or used for

commercial purposes without prior written permission from Korea Risk

Group.