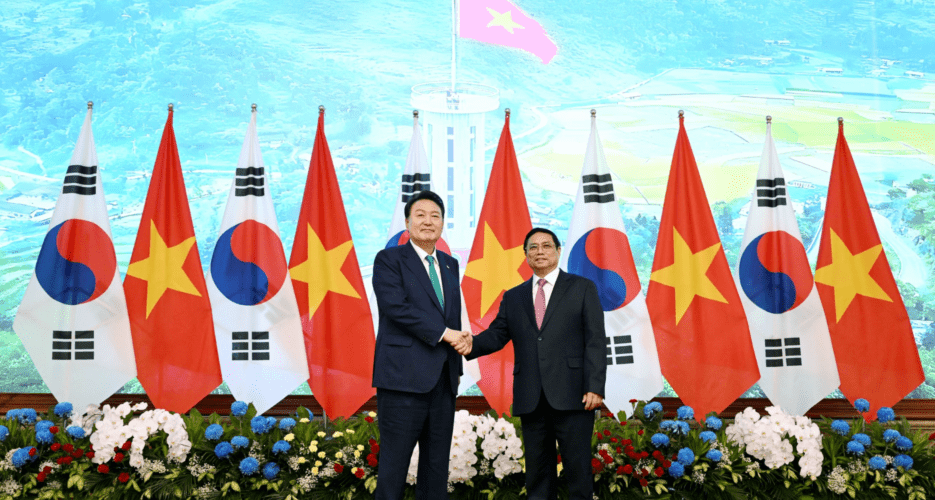

South Korea has heavily invested in Vietnamese market, but talent acquisition and lacking infrastructure create hurdles

Since establishing diplomatic relations in 1992, South Korea has become one of Vietnam’s most significant investors. It has also become a key export market for various Vietnamese goods, such as electronics and textiles, marking a vibrant trade relationship.

The robust presence of South Korean companies in Vietnam, such as Hyundai Motor Company, Lotte Group, LG Electronics, Samsung Electronics and SK Group, highlights this solid economic foundation. Their investments reached $81.5 billion across 9,666 projects by July 2023.

Since establishing diplomatic relations in 1992, South Korea has become one of Vietnam’s most significant investors. It has also become a key export market for various Vietnamese goods, such as electronics and textiles, marking a vibrant trade relationship.

The robust presence of South Korean companies in Vietnam, such as Hyundai Motor Company, Lotte Group, LG Electronics, Samsung Electronics and SK Group, highlights this solid economic foundation. Their investments reached $81.5 billion across 9,666 projects by July 2023.

Get your

KoreaPro

subscription today!

Unlock article access by becoming a KOREA PRO member today!

Unlock your access

to all our features.

Standard Annual plan includes:

-

Receive full archive access, full suite of newsletter products

-

Month in Review via email and the KOREA PRO website

-

Exclusive invites and priority access to member events

-

One year of access to NK News and NK News podcast

There are three plans available:

Lite, Standard and

Premium.

Explore which would be

the best one for you.

Explore membership options

© Korea Risk Group. All rights reserved.

No part of this content may be reproduced, distributed, or used for

commercial purposes without prior written permission from Korea Risk

Group.