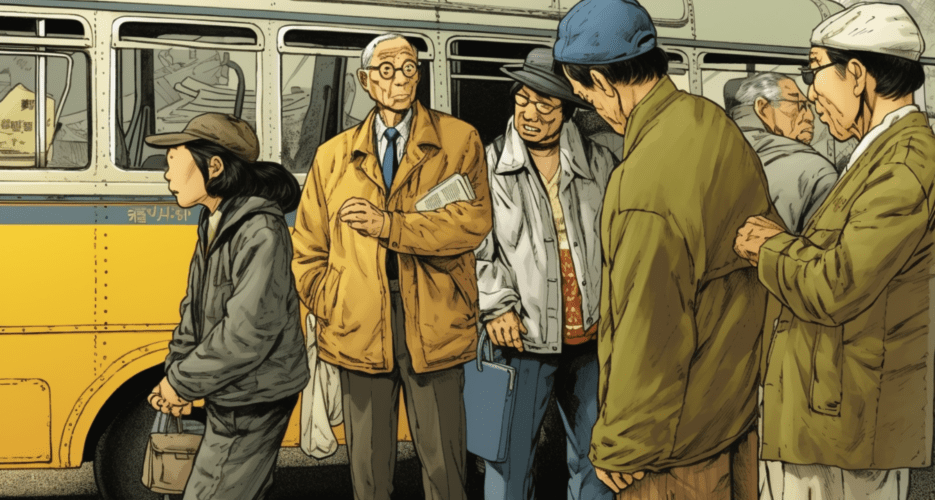

Aging population threatens sustainability of system, forcing hard choices about retirement, immigration and more

In the short term, South Korea’s national pension finds itself in a favorable position. The country boasts low debt, high savings rates, a highly educated workforce and some of the region’s most advanced technology firms, and the pension system has managed to run a surplus for years.

But looking not far into the future, it’s evident that looming demographic challenges due to the country’s world-lowest birth and fertility rates pose serious problems for the sustainability of the National Pension Fund (NPS), which is at the center of retirement planning for tens of millions of South Koreans.

In the short term, South Korea’s national pension finds itself in a favorable position. The country boasts low debt, high savings rates, a highly educated workforce and some of the region’s most advanced technology firms, and the pension system has managed to run a surplus for years.

But looking not far into the future, it’s evident that looming demographic challenges due to the country’s world-lowest birth and fertility rates pose serious problems for the sustainability of the National Pension Fund (NPS), which is at the center of retirement planning for tens of millions of South Koreans.

Get 30 days

of free access to

KoreaPro

Full access to all analysis

The KOREA PRO newsletter, every business day

Daily analysis on the top story of the day

The ability to suggest topics for coverage by our specialist team

Be smart about South Korea

Get full access to expert analysis and opinion.

Start now

No charges during your trial. Cancel anytime. A paid subscription will start after 30 days.

© Korea Risk Group. All rights reserved.

No part of this content may be reproduced, distributed, or used for

commercial purposes without prior written permission from Korea Risk

Group.